Diversification is a key pillar of any investing strategy. And while many individual investors use commercial real estate to diversify their portfolios outside of the usual stocks and bonds, have you ever considered how diverse your commercial real estate investments themselves can be? In addition to diversifying by asset class, risk level, or sponsor type, it’s also possible to diversify by geography–from an entire region down to the city level.

But what are the best cities for commercial real estate investors? Outside of the 24-hour cities like Los Angeles, New York, or Chicago–which are often cornered by institutional investors–which markets have the highest investment potential?

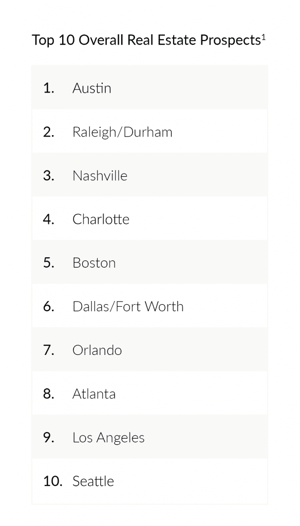

The Urban Land Institute (ULI), the world’s largest network of real estate and land use experts, produces an annual report that identifies which cities they believe have the highest investment potential. The majority of the top ten cities for 2020 are secondary, or “18-hour,” cities.

Austin, for instance, jumped from sixth place in 2019 to first in overall real estate prospects and from fourth to first place in local expectation of investor demand in 2020. ULI argues that “its slogan (“Keep Austin Weird”), deep pool of talent, unique and popular lifestyle, and ambitious commitment to business and real estate expansion” are all reasons for its strong investment potential. Of the 80 markets ULI analyzes, Austin also has the highest projected population growth rate for the next five years. And commercial real estate development is booming with a $1 billion North Austin Apple campus, a multi-developer transit-oriented development, and a major airport expansion project in the works.

What do many of the top ten cities have in common?

- These markets have a lower cost of living and more affordable housing compared to 24/7 metros like LA and NYC.

- Their job and population growth is above national averages, which indicates a market’s economic health and gives us some insight into employers’ confidence in the market. Employment growth can also be used as an indicator of future growth.

- They’re supported by a diverse employment base, often with companies relocating to the area and/or expanding their footprint. This means there is likely a lower unemployment rate.

- They have a growing Millennial population since younger workers are relocating in search of well-paying jobs, affordable housing, and a live-work-play balance. As the largest cohort of the workforce, Millennial migration greatly impacts the employment growth of an area as they move in.

- They are seeing an influx of institutional capital, such as investments made from pension funds, endowments, or foundations, etc. They represent where the ‘big money’ is moving.

According to ULI, the best cities for 2020,

“…show a strong representation of midsized markets. Austin, Raleigh/Durham, Nashville, Charlotte, and Orlando, ranging in size from 1.9 million to 2.6 million in population, are among the highest in projected population growth and net migration. Larger metropolitan statistical areas (MSAs) like Dallas and Atlanta also rate highly in anticipated growth. In contrast are Boston and Los Angeles, major metro areas with comparatively slow population expansion but whose vibrancy and critical mass generate potent energy for their substantial real estate markets.”

Historically, investors needed a strong, personal relationship with a local developer in order to find potential investment opportunities in “hot” markets. But one of the key benefits of online commercial real estate investing is that you don’t have to physically live in one of these top markets in order to find and invest in a project–you can learn about the market dynamics of any city, anywhere in the U.S., all from the comfort of your home. Industry leaders like ULI are constantly publishing in-depth research about the best cities for commercial real estate, and why those markets are worth investors’ attention.

Investing in multiple “best” cities at once

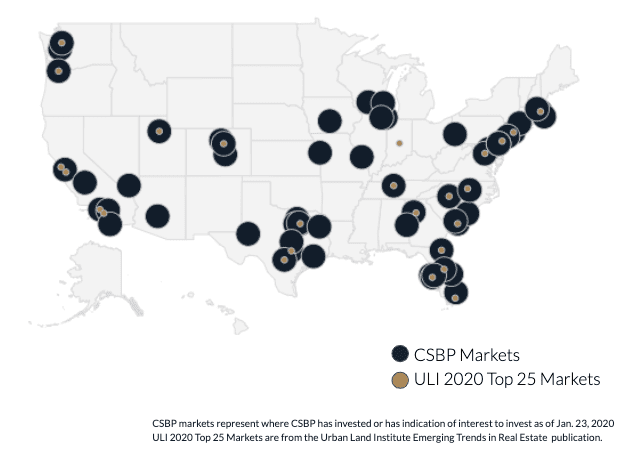

We launched the CrowdStreet Blended Portfolio (“CSBP”) to give our investors access to a diversified portfolio of 25+ Marketplace offerings–spread across multiple investment profiles, property types, and locations–with a single investment.

To date, CSBP has invested in 75+ deals in 60 U.S. cities, hitting 96% of ULI’s top 25 markets for 2020. To date, over 1,000 CrowdStreet investors invested more than $50 million in the first five Series of CSBP.

1. Source: Urban Land Institute Emerging Trends in Real Estate: United States and Canada 2020