A post-fundraise partnership that provides ongoing support for the lifecycle of your project.

Once your deal comes off the Marketplace

Our Account Management team works with you for the lifetime of your project, providing ongoing training and support for you and your team to help you leverage the full power of the CrowdStreet platform. We’re here to ensure we’re successful together. As your partner, we’ll routinely follow up with you to remind you of important reporting deadlines and provide ongoing best-practices for communicating with investors.

With CrowdStreet, I went from spending 25% of my time managing investors to 1%.

Joe Ollis, Founder/COO, SMARTCAP

Read the case study >

Consistency goes a long way in building trust with investors post-fundraise. We ask that you commit to being responsive, reliable, and honest when it comes to communicating with the investors in your deal.

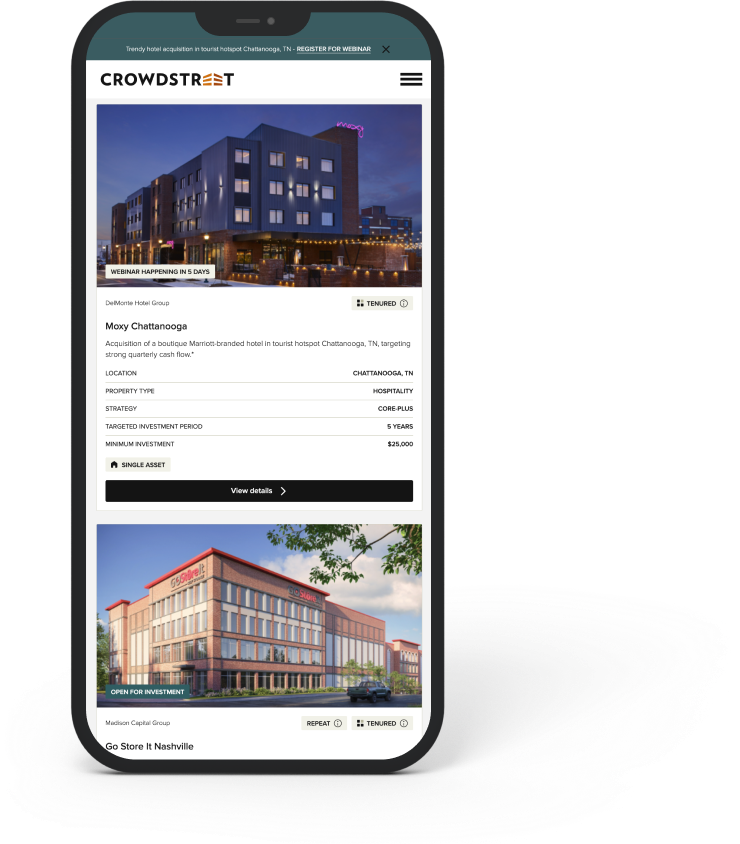

What does it take to raise capital with CrowdStreet?

Still have questions? Our Capital Markets team can help.