Invest directly in individual real estate opportunities.

Invest in several properties with a single investment.

Discover opportunities that align with your goals.

We work with some of the nation’s top real estate sponsors to bring you a wide range of carefully curated deals across various property types, regions, and strategies.

We provide you with exceptional detail and direct communication with sponsors, so you can make informed decisions.

Curate a tailored real estate portfolio by selecting individual deals that support your unique investing objectives.

-2.png?width=821&height=696&name=Group%202010216%20(2)-2.png)

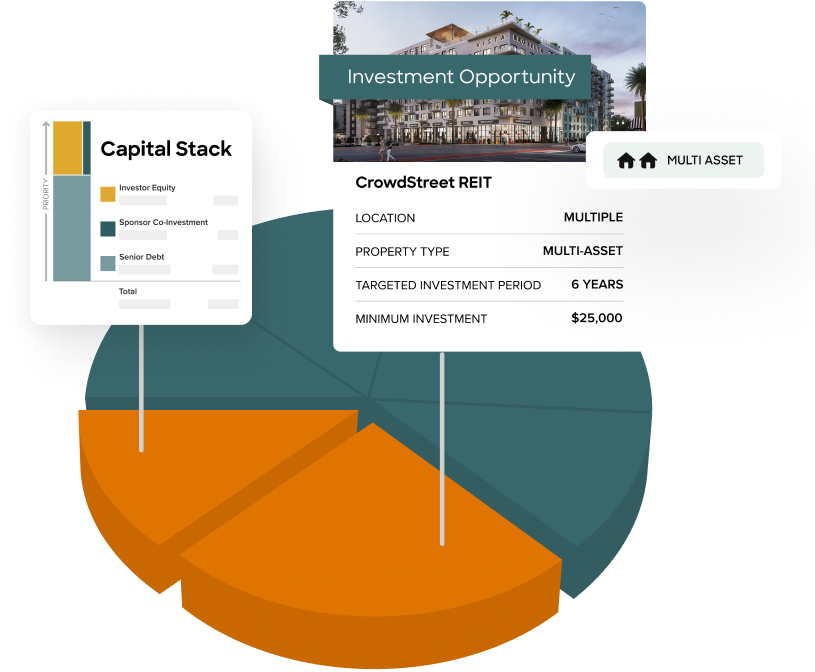

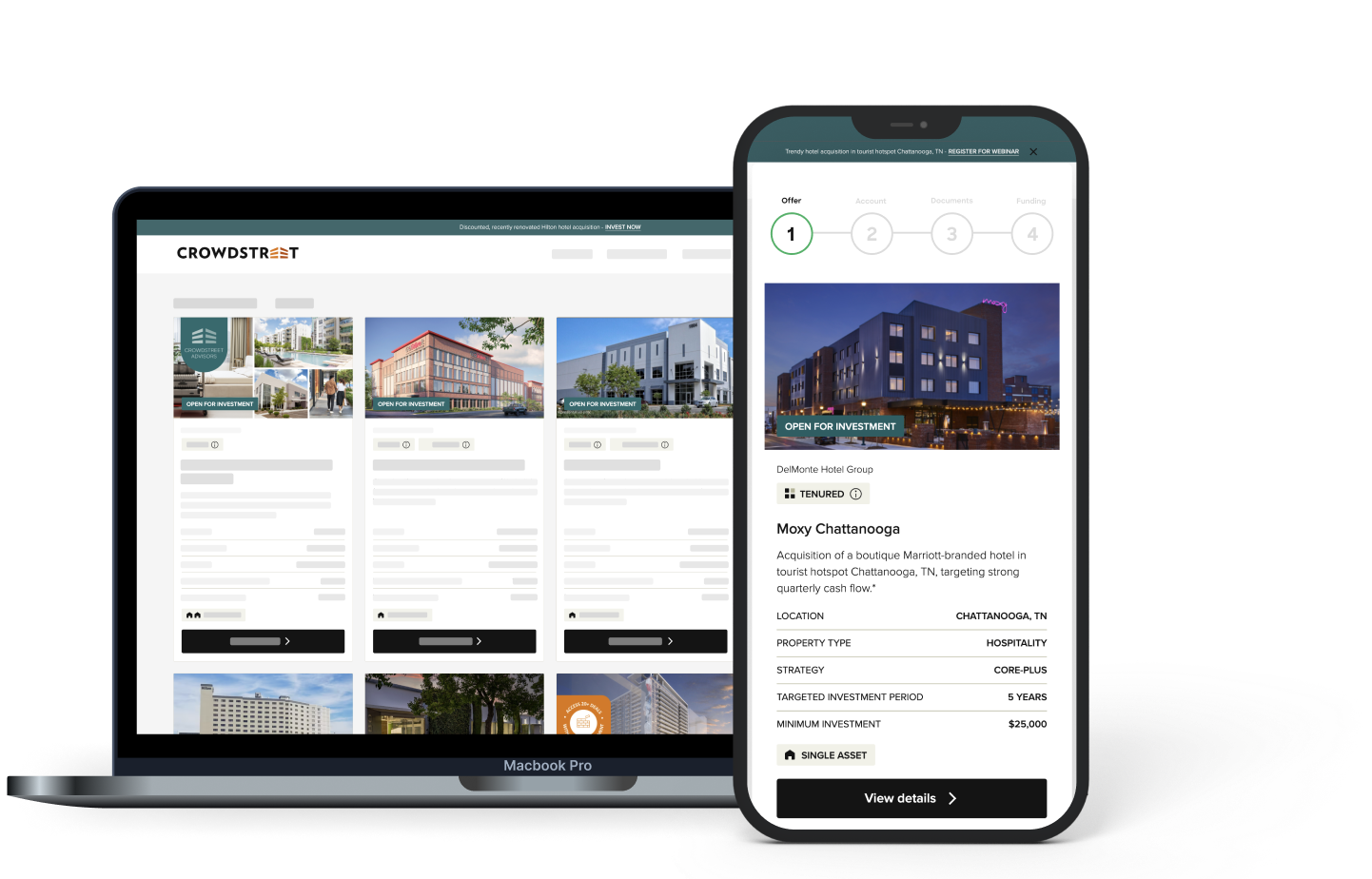

Invest in several properties with a single investment.

Quick and easy access into a diversified portfolio.

Crowd Street Advisors funds are constructed and managed by Crowd Street Advisors’ in-house real estate team, while sponsor funds are led by the sponsor and typically focus on the firm's property or regional experience.

Spend less time and effort building your real estate portfolio while potentially gaining exposure to multiple property types, sponsors, and regional markets.

Funds require a minimum investment similar to individual deals, yet offer exposure to multiple projects, helping potentially diversify your investment.

.png?width=608&height=931&name=Device-Mobile-Front-Floor%20(2).png)

.png?width=64&height=64&name=chart_data_FILL1_wght400_GRAD0_opsz48%20(1).png)

-1.jpg)