While I do believe the CRE market is in a cyclical recession, I think statements along these lines present as sensationalist in nature.

A recent report shared by Politico headlined that the $1.5 trillion in mortgages coming due within the next three years is “a potential time bomb”. Elon Musk piled on when he tweeted that commercial real estate is “melting down fast.”

It is undeniable that the office sector has a lot to contend with, but CRE is more than the office sector. Trepp (a quality third party data provider) shows that Lodging, Retail, and Office have the highest delinquency rates (which are actively ticking up) while Multifamily and Industrial have the lowest delinquencies.

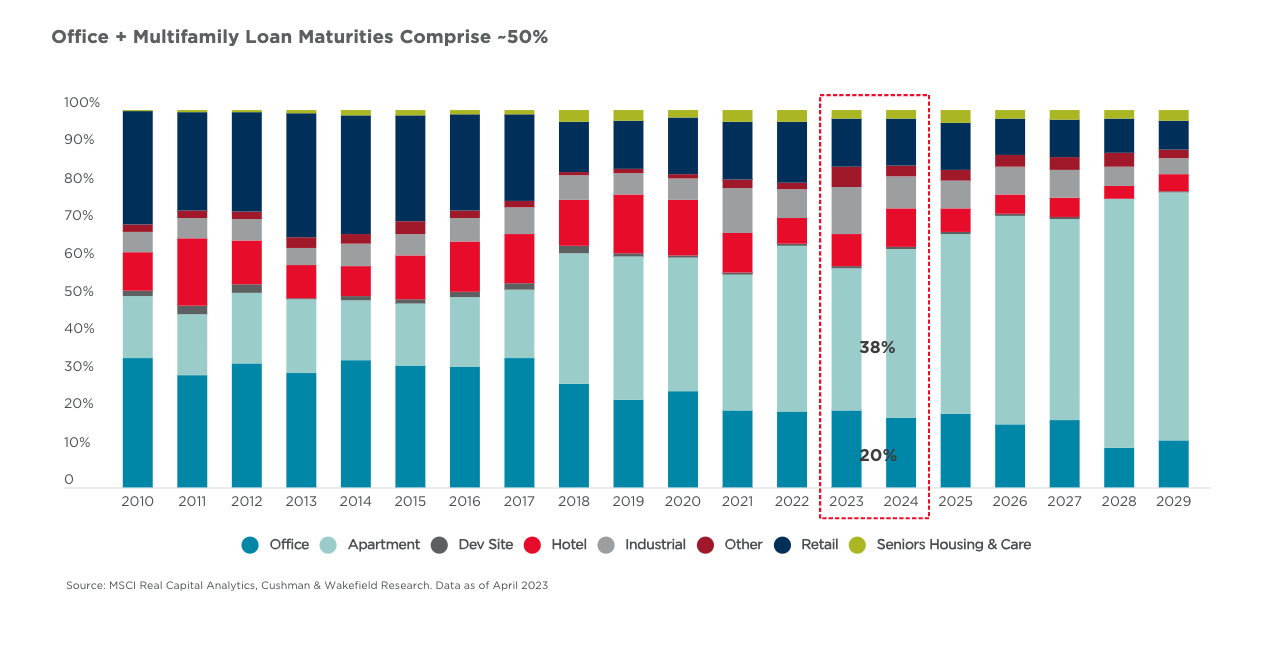

But while Office is under the spotlight, it is not the biggest borrower. According to a report by WolfStreet, the office sector makes up only about 17% of total income producing outstanding CRE loans, while Multifamily has the most exposure, making up about 44% of the loans. According to Cushman & Wakefield, office makes up only about 20% of the mix of the loans that are expiring within the next two years, while Multifamily makes up about 30%. Most of these Multifamily loans are not expected to be in distress.

Even for the Office sector, we're already starting to see that lenders are working with operators on modified loan packages, something we last saw at scale during the Global Financial Crisis. And here’s why: when a property is in distress due to reasons associated with operator error, lenders have an incentive to foreclose.

But in a market like today where the distress is macro driven, I expect that there will be a greater propensity for lenders to consider loan modifications, which can include infusions of equity and reserves, extensions of loan maturities, and other creative measures that lenders can use to help ensure those distressed properties stay off their balance sheets.

Case in point: the real estate agency RFR Realty kicked the can on a $1 billion debt package (which included a $783 million CMBS loan) on its 831K sq.ft.office tower at 375 Park Avenue in New York. More such examples continue to surface each day, and I expect this trend to continue as we dust off the “extend and pretend” strategy of the past.

So, are CRE debt maturities a “time bomb”? Not really. The way I see it, operators and lenders will continue to work together on distressed situations to determine how to defuse not one major time bomb, but a series of small incendiary devices over the next three years.

Figure: Office + Multifamily Loan Maturities Comprise ~50% - Cushman & Wakefield

Disclaimer: CrowdStreet, Inc. (“CrowdStreet”) offers investment opportunities and financial services on its website. Advisory services are offered through CrowdStreet Advisors, LLC (“CrowdStreet Advisors”), a wholly-owned subsidiary of CrowdStreet and a federally registered investment adviser. CrowdStreet Advisors provides investment advisory services exclusively to privately managed accounts and private funds and does not otherwise provide investment advisory services to the CrowdStreet Marketplace

This article was written by an employee(s) of CrowdStreet Advisors and the contents of this publication are for informational purposes only. Neither this publication nor the financial professionals who authored it are rendering financial, legal, tax or other professional advice or opinions on specific facts or matters, nor does the distribution of this publication to any person constitute an offer, recommendation, or solicitation to buy or sell any security or investment product issued by CrowdStreet or otherwise. The views and statements expressed are based upon the opinions of CrowdStreet Advisors. All information is from sources believed to be reliable. This article is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance or success. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. CrowdStreet assumes no liability in connection with the use of this publication.

All information, content, and materials referenced in this memo are for general informational purposes only. This memo may contain links to other third-party websites. Such links are only for the convenience of the reader and CrowdStreet nor its affiliates do not recommend or endorse the contents of the third-party sites.