Retail Outlook

Over the last decade, retail market fundamentals have strengthened, with record-low availability rates and strong rent growth reported by CoStar.41 However, rent growth is expected to moderate due to a slowdown in consumer spending and inflation.41 Despite some stores closing42, CoStar41 and Nuveen44 report that grocery-anchored and lifestyle retail remain resilient, with improved foot traffic anticipated, especially in the Sunbelt region. Despite a recent dip in leasing activity according to MSCI Real Capital Analytics, CoStar reports that competition for prime retail locations remains strong, underscoring sustained demand for well-located properties.41

Within the last decade, retail market fundamentals have become increasingly strong with CoStar reporting their lowest national vacancy rate of 4.1% in 2024, with just over 0.4% of inventory currently being developed, which has consistently dropped from 0.8% in 2017.41 While new supply is scarce, CoStar reports strong demand in food and beverage, grocery, discount and experiential retail demand.41

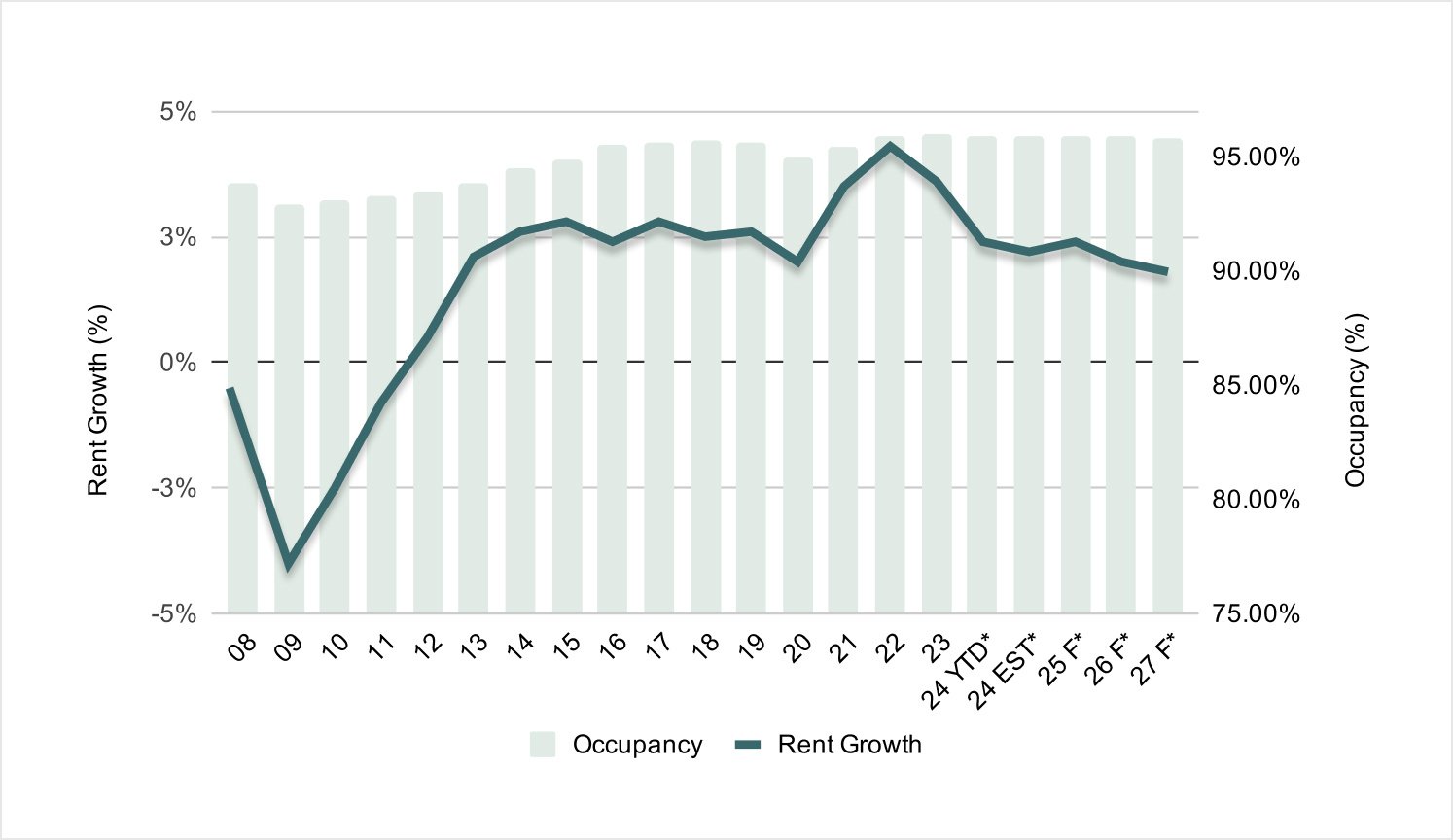

According to CoStar, rents increased by CoStar’s highest historical rate recorded for retail, at 4.3% due to strong demand and limited space availability and by 2024, CoStar expects this growth to slow to 2.2% annually as consumer spending is forecasted to moderate, partly due to the lingering effects of high inflation.41 However, CoStar states that the Sunbelt region should see rents stay above the average, driven by strong market fundamentals, typically including more substantial buying power, higher foot traffic, and limited expansion options.41

According to CoreSight Research, for the first time since 2013, more stores opened than closed in 2023, but store closures are rising again and there is an anticipated 24% increase in store closures for 2024 as compared to 2023.42 While the ongoing trend of store closures is persisting primarily due to ongoing bankruptcies and tenants rightsizing their portfolios, some retailers are strategically consolidating by shuttering underperforming stores to navigate through the current economic uncertainties which may be adding to these closures.42 Additional reasons that have led to store closures include poor management, such as for RiteAid and Rue21, or some discount stores, such as Family Dollar and 99CentsOnly, that cater to lower-income households where the consumer is feeling the pinch of inflation, affecting foot traffic.42

Overall, securing prime retail locations remains fiercely competitive due to record-low availability and high demand as per CoStar. CoStar also reports that there has been a slight decrease in leasing activity within the last four quarters, primarily due to a shortage of well-located properties rather than a decline in demand. Due to tight availability, many seek to expand but find limited suitable options in sought-after locations.41

Retail sales were down 29% yearly compared to 39% for the overall CRE assets tracked by MSCI Real Capital Analytics, with the sharpest lull in single-asset sales according to their May 2024 Capital Trends report. The decline varied by retail property type, with center sales decreasing by 27% yearly and single-asset sales down 32% yearly.46

Despite declining sales, Green Street and MSCI Real Capital Analytics data indicate that retail showed relatively low price volatility compared to other major CRE assets following the interest rate hikes in 2022.41,23 This trend can be attributed to the sector's adaptation to the "retail apocalypse"43 over a decade, during which numerous retailers faced bankruptcy or downsizing, prompting innovation and recovery. Consequently, much of retail has generally become "pressure-tested," with much of this resilience factored into its pricing.

CBRE reports that foot traffic in major retail districts has shown vital signs of recovery since the pandemic, and projections are that it will reach or even surpass pre-pandemic levels by the end of 2025.47

For retail transactions to improve, we believe foot traffic must continue to recover in addition to an overall reduction in interest rates, an alleviation in rising operating costs for tenants, a relief in labor shortages, a lowering of construction expenses, and the spillover effects of increased interest rates on business growth.

According to Nuveen, grocery-anchored neighborhood centers and lifestyle/open-air retail offer opportunities due to their durable demand drivers and limited new supply, which is expected to see continued transaction activity.44

As consumer spending is moderating48, we're focusing on the mix and financial health of retail tenants. While we have generally remained somewhat market agnostic for retail from a geographic standpoint, assuming the retail center is close to major trade areas, we continue to prefer the grocery-anchored neighborhood or community centers due to their sustained performance over the last few years as opposed to traditional shopping malls or second-tier big-box stores.

The non-discretionary nature of grocery shopping helps to keep the fire burning for this subtype. We will typically consider centers with credit-quality anchor grocers and prominent brands that may have the potential to boost the center’s earnings with their historically higher foot traffic. However, we will cautiously approach centers catering mainly to lower-income demographics as this group may affect foot traffic due to financial pressures evident through rising credit card debt and the underperformance of discount stores such as Five Below.

Opportunities in retail vary depending on the center type, location, and performance. However, math is one of the first things to consider, particularly in today’s high interest rate environment. Depending on the retail property's type and vintage or age, higher overall cap rates may make some deals viable candidates with the potential to achieve positive leverage at acquisition. When considering investments in the retail sector, we will likely continue to prioritize this aspect as it is a differentiator for retail real estate in a high-interest rate environment. Also, the Triple Net (NNN) nature of rents may help limit the effect of spiking insurance, maintenance, and tax costs, as these are traditionally passed on to the tenant.

* Positive leverage occurs when the debt costs less to service than the cash flow received from the leveraged portion of the project (negative leverage is the opposite when the debt service exceeds the cash flow on the leveraged portion of the project). Another way to tell if leverage is positive is when a deal's operating cap rate is greater than its debt's interest rate.

- CoStar, Markets, Retail, Data Export, July 2024. Data as of 7/16/24

- “Store closures are surging this year,” CBS News, May 2024.

- “Retail Apocalypse,” Wikipedia, Accessed July 2024.

- “U.S. Retail is shaping up to outperform in 2024,” Nuveen, March 2024.

- “Key Engines of US Consumer Spending Are Losing Steam All at Once,” Bloomberg, June 2024.

- Capital Trends, US Retail, MSCI Real Capital Analytics, May 2024. Data as of 7/16/24.

- “Reports of Street Retail’s Demise Are Greatly Exaggerated,” CBRE, May 2024.

- “Key Engines of US Consumer Spending Are Losing Steam All at Once,” Bloomberg, June 2024.