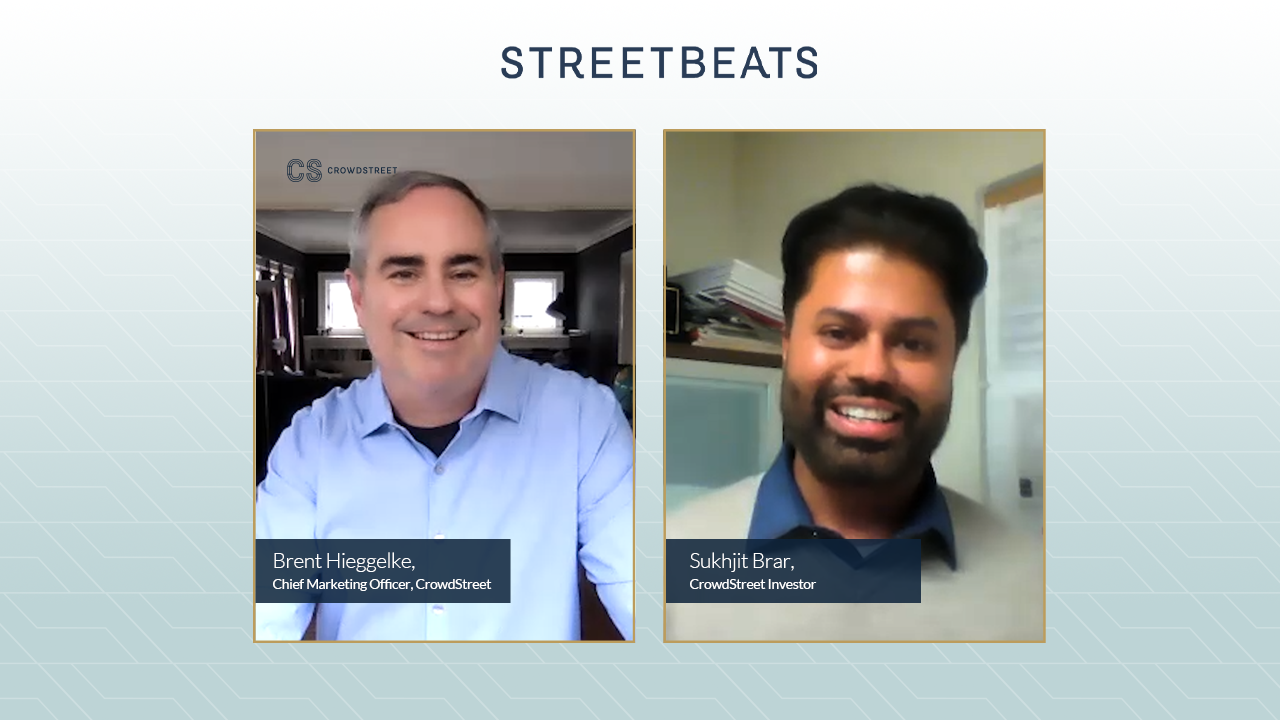

Crowd Street's Brent Hieggelke is joined by one of our investors, Sukhjit Brar, to hear his story of how he got started in commercial real estate investing. Sukhjit also discusses the types of asset classes he's been keeping an eye on, why projects with a social impact are important to him, and how he's utilized the Crowd Street platform to further educate himself on real estate investing.