18-hour cities are defined as second-tier cities with above-average urban population growth that offer a lower cost of living and lower cost of doing business relative to first-tier or “24-hour” cities. In the U.S., 24-hour cities essentially translate to our gateway cities of Boston, Chicago, Los Angeles, New York, San Francisco and Washington, D.C.

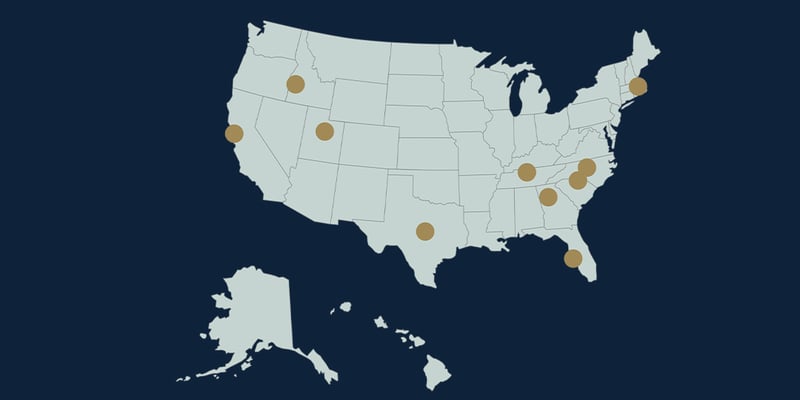

As the real estate industry has come to know and embrace the concept of the 18-hour city, the poster children for this emerging class of up-and-coming locations around the U.S. include second-tier metros such as Denver, Austin, Portland and Nashville.

The concept of the 18-hour city is important because once identified, the label has proven to be a good prognosticator of growth. The Urban Land Institute (ULI), for example, has tracked the progress of cities it designates as 18-hour and the data is compelling. ULI’s Emerging Trends in Real Estate 2017 is a great resource on this topic and I recently published an editorial article on its findings. If a city has quantifiable success in attracting Millenials with a solid and growing job base, yet is more affordable than the 24-hour cities from which they are migrating, it is logical to believe that it can thrive.

Anyone who has previously lived in a 24-hour city and now lives in an 18-hour city (such as myself) can appreciate the relative step up in quality of the 18-hour city lifestyle, particularly at a time when our 24-hour cities have a high cost of living coupled with crippling congestion.

While 18-hour cities such as Denver, Austin, Portland and Nashville still look attractive from a mid-to-long-term perspective, they are arguably more mature in the cycle of their 18-hour growth story.

In this article, we make the case for four emerging 18-hour cities that might become the future darlings of the urbanization movement.

Milwaukee, WI

| 2016–2017% population change | 5-year Millenial growth | GMP per capita 5-year projected growth | 2016–2017% employment change | |

| United States | 0.8% | 2.6% | 1.4% | 1.5% |

| Milwaukee | 0.2% | 6.8% | 1.0% | 1.7% |

-Emerging Trends in Real Estate ® 2017

With a $2.5 billion surge in investment in construction projects, Milwaukee’s downtown is experiencing an urban renaissance. Major investments in a new sports arena, hotels, streetcar, office buildings and highways reflect the progressive vision of the city and it will translate into striking changes to the cityscape over the next five years.

For example, the Wisconsin Entertainment and Sports Center, a $524 million downtown sports and entertainment complex that will be new home to the Milwaukee Bucks basketball team, is already proving to be a huge catalyst for additional private development in the area. Expected for completion in 2018, the arena complex will be located just a few blocks from the Wisconsin Center convention center and major convention hotels.

New hotels: Milwaukee has added a few new hotels to its downtown:

- Kimpton Journeyman: Completed in 2016, the 158-room hotel features an eight-story building housing a chef-driven, destination restaurant on the ground floor, plus a rooftop bar and expansive meeting space.

- Springhill Suites Milwaukee: Also opened in 2016 directly across from the Wisconsin Center, this hotel offers 150 rooms in the 97-year-old, fully renovated Commerce Building, which is tied to the city’s skywalk system, also linking to the Wisconsin Center.

- The Hyatt Regency Milwaukee: This hotel opened in November 2015 and features a sleek, rooftop event space with panoramic views of the city.

Milwaukee Streetcar: Scheduled to commence construction in April 2017, the highly anticipated Milwaukee Streetcar system is planned to connect 80,000 downtown workers, 25,000 downtown residents and millions of annual visitors. In its first phase, a 2.5-mile route will link the Milwaukee Intermodal Station (and its 1.4 million annual users) with hotels, businesses and attractions downtown, in the Historic Third Ward, Lakefront and lower East Side. As we have seen in other cities, urban light rail systems often bring good things to those submarkets.

New office and multifamily towers: Adding impressive new architecture to the lakefront skyline, Northwestern Mutual has broken ground on a new $450 million, 32-story Tower and Commons area overlooking Lake Michigan (rendered above). The project is slated for delivery later this year. Also, in the same area as the Northwestern Mutual Tower, a 17-story office building, known as 833 East, was delivered in the summer of 2016.

As for multifamily developments, Couture, a 44-story, $122-million apartment tower development has just gained final approval. This transit-oriented residential high rise development will have the Milwaukee Streetcar running through its base. In addition, Northwestern Mutual is also embarking on 777 N. Van Buren St., a $100 million Class A+ 34-story luxury mixed-use residential tower.

With a mix of hospitality, office and residential development, the velocity of downtown development is notable. These recent and upcoming deliveries stand to have economic impacts in the downtown area in the years ahead.

Metro Risks to consider:

- Job Growth – Milwaukee is still experiencing lower than national average job growth. If job growth remains muted, it becomes more challenging to experience strong rent growth.

- Population Growth – Population growth is also lower than the national average. Part of the thesis behind Milwaukee’s urban renewal is to attract and retain more residents than its historical average.

- Lower stabilized cost to exit cap rate spread: Currently, Milwaukee’s developers will build at spreads in stabilized yield to cost to exit cap sometimes as skinny as 100 basis points. This spread is markedly lower than other faster-growing secondary markets (that currently benefit from lower exit cap rates) where the spread on stabilized yield on cost to exit cap rate may be as high as 250 basis points. The more spread, the more potential for profit and room for margin of error. The current environment in Milwaukee suggests that its developers believe in the potential for this spread to widen in the future. For investors, sharing in this belief is part of the reason behind investing in the region.

Columbus, OH

| 2016–2017 % population change | 5-year Millenial growth | GMP per capita 5-year projected growth | 2016–2017 % employment change | |

| United States | 0.8% | 2.6% | 1.4% | 1.5% |

| Columbus | 1.1% | 7.3% | 1.6% | 2.4% |

-Emerging Trends in Real Estate ® 2017

For a second-tier city, Columbus possesses three important demand drivers from a real estate perspective:

- It is the state capital

- It is home to The Ohio State University, one of the nation’s largest universities

- It is home to five Fortune 500 companies

These factors have helped maintain a stable economic base that has provided consistent job growth that is driving real estate rent growth. The presence of The Ohio State University, in particular, is creating demand for walkable development across multiple neighborhoods in proximity to the school.

In addition, Columbus has a growing downtown resident population, which is a key attribute of an 18-hour city. With a target to reach 10,000 downtown residents by 2018, the city crested 8,000 residents as of mid-2016 according to local study conducted by the Capital Crossroads Special Improvement District and Discovery Special Improvement District. The study also noted $501 million of new construction projects underway with $1.2 billion of proposed investment.

Finally, Columbus benefits from its ability to reach a large number of people by truck in a day, which helps to fuel demand for industrial distribution space in an era of rising e-commerce sales. Overall, Columbus’ sustained growth and relatively unique combination of demand drivers make it an emerging 18-hour city.

Metro Risks to consider:

- Failing to consistently rise in ULI’s ranks: If a metro is emerging onto the 18-hour city radar, you would hope to see it consistently climb in ULI’s annual “overall real estate prospects” ranking it publishes each year in its Emerging Trends in Real Estate®. For example, from 2015 – 2017, Portland, OR saw its ranking climb from 16th to 9th to 3rd out of 78 tracked metros. Unfortunately, Columbus began it rise from 37th to 27th in 2015 – 2016 only to fall back to 42nd in 2017. Apparently, ULI does not have consensus amongst its polling population as to which direction Columbus Is headed.

- L Brands: L Brands, one of five Columbus-based Fortune 500 companies, is struggling. Year-over-year sales in its flagship brand, Victoria’s Secret are plummeting and L Brands stock is off 47% from its 52-week high. With 5,200 local employees, L Brands has the potential to put a dent into Columbus’ otherwise steady growth.

- State budget exposure: With the stability of over 22,000 local state jobs also brings with it some dependence on the Ohio state budget. In December of 2016, Governor Kasich s warned his state lawmakers of a 1.2% drop in year-to-date tax revenues from the previous year. If Ohio does end up with a drop in 2016 annual tax revenues, it would put an end to two years of growth and draw into question the sustained growth of the state economy.

Charleston, SC

| 2016–2017 % population change | 5-year Millenial growth | GMP per capita 5-year projected growth | 2016–2017 % employment change | |

| United States | 0.8% | 2.6% | 1.4% | 1.5% |

| Charleston | 1.5% | 7.3% | 1.3% | 1.8% |

-Emerging Trends in Real Estate ® 2017

Charleston has all the right things going for it to hit the 18-hour city radar with an attractive blend of downtown vibrancy, job growth and population growth.

Downtown vibrancy: 18-hour cities rely upon vibrant urban cores to provide a hub for growth and Charleston has this in spades. So much so, that in 2016 Travel and Leisure ranked Charleston its #1 city in the world. Charleston leverages its rich history, jasmine-scented streets, award-winning hotels and active restaurant scene to curate a distinctive antebellum charm. Toss is a coastal location with the beautiful waterfronts at Sullivan’s Island and Folly Beach and it is no wonder that the U.S. is in love with Charleston.

Job Growth: Charleston isn’t just an attractive tourist destination – it’s a metro with a stable and growing labor force. According to the Charleston Chamber of Commerce, the metro experienced 3.5% job growth in 2016 and it expects to grow by 3.9% or 10,000 new jobs in 2017. As of December 2016, unemployment fell to 3.5%, compared to the national average of 4.5%.

On the manufacturing front, Boeing’s acquisition of Vought Aircraft Industries in 2009 has resulted in nearly $3.7 billion of economic benefit to the Charleston area per Business Insider. Boeing’s facility in North Charleston, is one of two locations that conducts final assembly of the 787 Dreamliner. In addition, one automaker is starting a major expansion while another is opening a new production facility. Auto production activity could lead to an influx of new parts suppliers locating in the region.

Aside from manufacturing, Charleston is becoming a preferred destination for college graduates between the ages of 25 to 34. Per Business Insider the younger well-educated workforce is facilitating the growth of Charleston’s expanding tech base and high-tech employment is projected to expand at a faster pace than the national average in 2017.

Finally, the Port of Charleston should benefit from the Panama Canal expansion. Planned capital expenditures at the port are aimed at improving the competitiveness of the operation and further establishing Charleston’s reputation as a logistics hub.

Population growth: One way to gauge future demand for real estate in a metro is to track population trends. Growing populations typically increase demand for housing first and then other asset classes such as office and retail later as the effects of the increased population are felt. According to United Van Lines’ 2016 Annual Movers Study, South Carolina ranked fifth for inbound moves with a 60% / 40% inbound-to-outbound moving ratio.

Also per the study, the largest demographic segment of Charleston’s inbound population is baby boomers with annual incomes of $100,000 or greater. This inbound population may drive demand most heavily in the housing sector and then in the retail sector, once those well-heeled boomers are settled. In the years ahead, job growth in the healthcare sector may follow to service Charleston’s growing population of senior citizens.

Metro Risks to consider:

- Global trade exposure – Given that Charleston is home to major production facilities including those of Boeing and BMW, these facilities expose the metro to downside risk in demand for the metro’s output if the protectionist policies of the Trump administration were to result in a trade war.

- Multifamily supply – While Charleston looks to have a bright future; it may have short-term risk in the multifamily sector. According to Colliers, the metro has 3,700 new units currently planned to begin construction with another 1,800 units set to deliver in the next 18 months. This level of supply has caused lenders to pause as the market contemplates whether it has hit a phase of oversupply. Continued absorption will depend upon maintaining strong population growth.

- Hurricanes – Charleston sits on the Atlantic Ocean in a tropical climate, which makes the city susceptible to hurricanes. The last major hurricane to hit Charleston was Hurricane Hugo in 1989, which, according to multiple sources, caused $10 billion of damage to the greater metro area.

Kansas City, MO

| 2016–2017 % population change | 5-year Millenial growth | GMP per capita 5-year projected growth | 2016–2017 % employment change | |

| United States | 0.8% | 2.6% | 1.4% | 1.5% |

| Kansas City | 0.5% | 4.1% | 0.6% | 1.9% |

-Emerging Trends in Real Estate ® 2017

Kansas City has historically leveraged a low cost of living to attract residents. But now, by adding an urbanizing core and momentum in tech talent, Kansas City has officially hit the 18-hour city radar.

Surging downtown: The ongoing transformation of downtown Kansas City is the single largest reason the city is an emerging 18-hour city. Since 2000, the city’s downtown has experienced more than $7 billion of capital investments, according to VisitKC.com. Downtown Kansas City has become a premier destination for employers, residents and tourists seeking an exciting live /work/play environment.

Part of the downtown surge is attributable to the virtuous cycle of a growing downtown population and booming multifamily market. Over the last decade, the downtown population has increased by 50%, while rental rates have grown by 45%. Despite deliveries of 861 units in 2015, downtown Kansas City maintained an average occupancy rate of 97.4% according to Hendricks Berkadia.

The hotel market in downtown Kansas City is similarly booming. There are currently more than 1,170 rooms planned for the downtown and Crossroads areas in nine different projects. Kansas City has also proposed a new, 800-room Hyatt convention hotel. These hotel rooms are expected to accommodate more events, including Chiefs, Royals and Sporting KC games, concerts at the Sprint Center or Kauffman Center, musicals at the Music Hall, the Big XII basketball tournament and the Kansas City Marathon. The additional rooms are also expected to accommodate Kansas City’s large employer base and increased convention business. VisitKC.com reports that downtown hotel occupancy increased 8.4% from last year with a 4.0% increase in average room rate.

Power and Light District: According to the Kansas City Business Journal, this $850 million entertainment district on the south end of Kansas City’s financial district is the largest new development project in the Midwest. It has re-energized downtown, creating an entertainment, retail and dining hot spot for visitors and conventioneers. Walk through the eight blocks of the Power & Light District, and you will discover a variety of local boutiques with the latest fashions and trends and an array of cuisines at the many restaurants and cafes. The district is anchored by KC Live, an entertainment plaza with two levels of high-energy bars, restaurants and nightclubs that feature live music.

New light rail: Kansas City understands that light rail is one of the key components of the 18-hour city. As such, its urban core will soon be enhanced by a $102 million, 2.2-mile streetcar line stretching from the River Market to Union Station in Crown Center. The system will be free to ride and easy accessibility. According to Sly James, Mayor of Kansas City, “When everything is done and laid and the streetcar is running, I think we’re going to see a city that we haven’t quite imagined before.”

The rise of tech: Kansas City is beginning to see acceleration in the growth of its technology sector employment. The reasons behind this are myriad, but the fact that Kansas City was Google’s debut Fiber city certainly doesn’t hurt. Helping to fuel tech employment is the fact that Kansas City is also now appearing on multiple top 20 lists for Millenial Growth. For example, a 2016 CBRE report cited Kansas City as a top 20 market for tech momentum. In addition, in 2013, Kansas City was named by Travel and Leisure as a top 10 city for Hipsters, edging out cities such as Seattle, Boston and Los Angeles.

One interesting data point to note on the startup front is the increase in venture capital funding that Kansas City has recently experienced. According to a study by Mattermark, Kansas City was up 296% year-over-year 2015-2016 in VC funding, ranking 3rd in the US on a percentage basis (Portland and St. Louis ranked first and second respectively). While the absolute dollar amount was still small at $10.2 million, it is significant to see a major uptick in VC spending in Kansas City during the same period that saw declines in the usual suspect markets of the Bay Area, Austin, New York, Washington D.C. and Seattle.

Still affordable: Part of the hook of Kansas City is that the momentum of its growth, urbanization and increasing “cool factor” is anchored by an attractive cost of living. For example, according to Numbeo, which tracks the cost of living of 139 North American cities, Kansas City ranked 117th in its total cost of living index, placing it on par with cities such as Cincinnati, OH and Rochester, NY. The data vary a bit depending on which source you consult, but the consensus is that Kansas City is a cheaper than average U.S. city.

Metro Risks to consider:

- Lower than average population growth – While Millenial growth has been relatively strong, the Kansas City metro is still seeing below-average total population growth. If Millenial growth subsides, it could lead to lower absorption of downtown properties.

- Tepid GMP growth – According to ULI, Kansas City’s projected 5-year GMP growth is 0.8% below the U.S national average. In addition, per kceconomy.org, Kansas City’s 1.49% 2014-2015 GMP growth ranked 43rd out of 52 1 million + person metros. For context, the nation’s highflying 18-hour cities such as Austin and Portland grew at 5.03% and 4.57% respectively. The thesis behind Kansas City’s emergence as an 18-hour city partially depends upon a future acceleration of these growth rates.

- Falling in ULI’s ranks: While Columbus’ ranking is bouncing around in ULI’s annual Emerging Trends in Real Estate® the past three years, Kansas City has actually consistently fallen from 2015-2017 from 33rd to 39th to 48th. Therefore, it’s fair to say that this author’s stance on Kansas City is counter to the consensus of those polled for ULI’s annual publication.

Finding the 18-hour recipe

While the attributes of 18-hour cities can vary, by now you should be able to appreciate that they tend to possess an attractive mix of growth, opportunity, culture, affordability and uniqueness that combine to create a sense of place. Milwaukee, Columbus, Charleston and Kansas City are all capturing variations of this mix to build more livable and vibrant urban communities. If they are not already meeting the definition of an 18-hour city, they are well on their way to achieving that status.

One of the greatest aspects of the rise of the 18-hour city is that it is enabling more and more Americans to express their individualism and “find their spot” rather than simply succumbing to the gravitational pull of our largest metros. This is not to say that the 24-hour cities of Boston, Chicago, Los Angeles, New York, San Francisco and Washington, D.C aren’t great cities or that they lack prospects of growth. Rather, the point is that lifestyles that were once only available in these cities are now spreading to a second tier of cities throughout the country. If you are able to identify elements of the 24-hour city lifestyle that are making its way to a city that has not yet already gained recognition as an 18-hour city, you may find a broad range of real estate investing opportunities.

Investing in these cities is no guarantee of success. Investors should keep in mind that there are risks to all investments and please review all materials related to an offering.