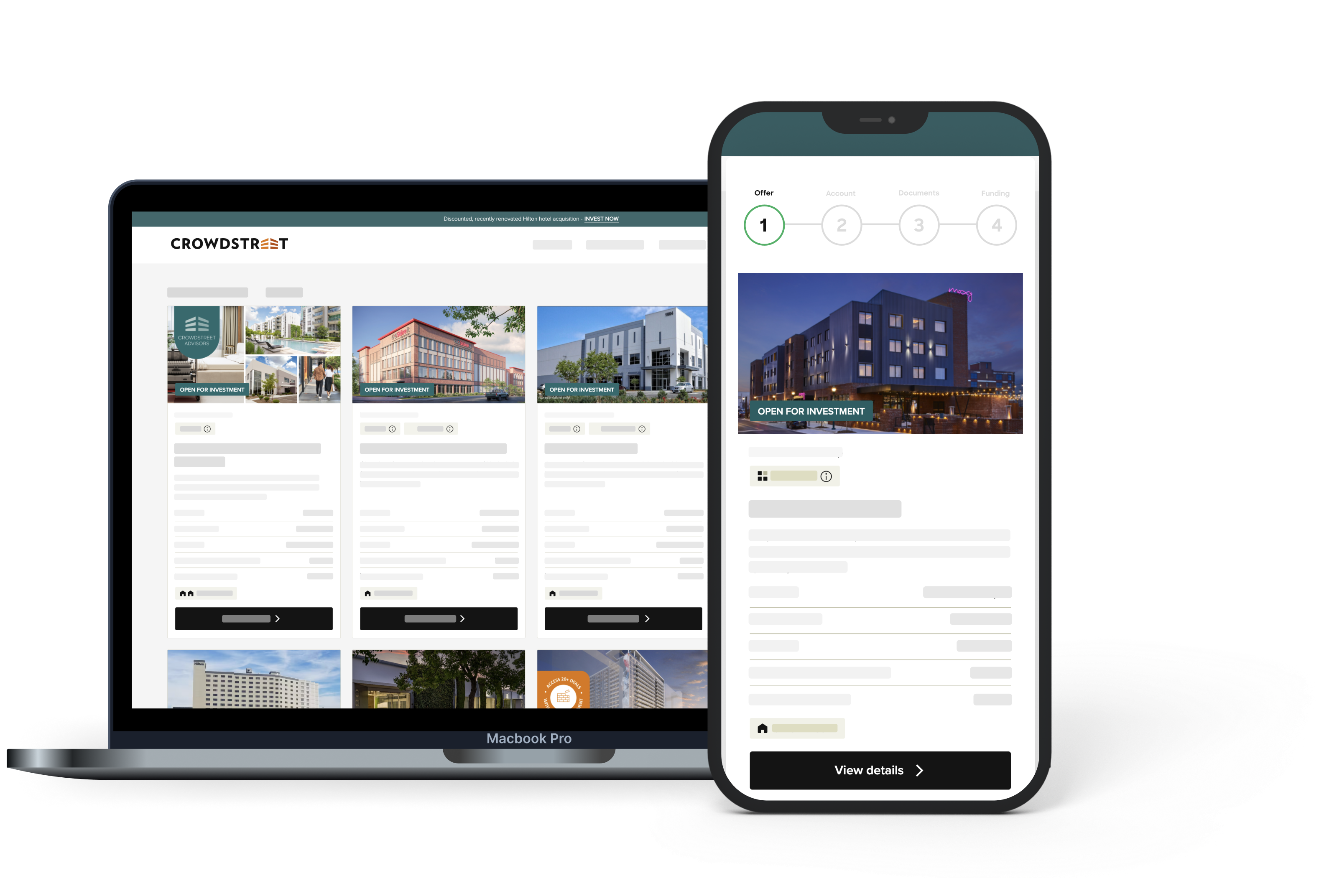

Unlock private investments and accelerate your financial ambitions.

As reported by Investopedia (Jan. 2024), CNBC (Jul. 2024), and Globest (Feb. 2024). Based on a variety of factors.

“One of the world’s top fintech companies of 2024”

“Best for Expert Real Estate Investors in 2024”

“2024 Rainmakers in CRE Debt, Equity & Finance”

As reported by Investopedia (Jan. 2024), CNBC (Jul. 2024), and Globest (Feb. 2024). Based on a variety of factors.