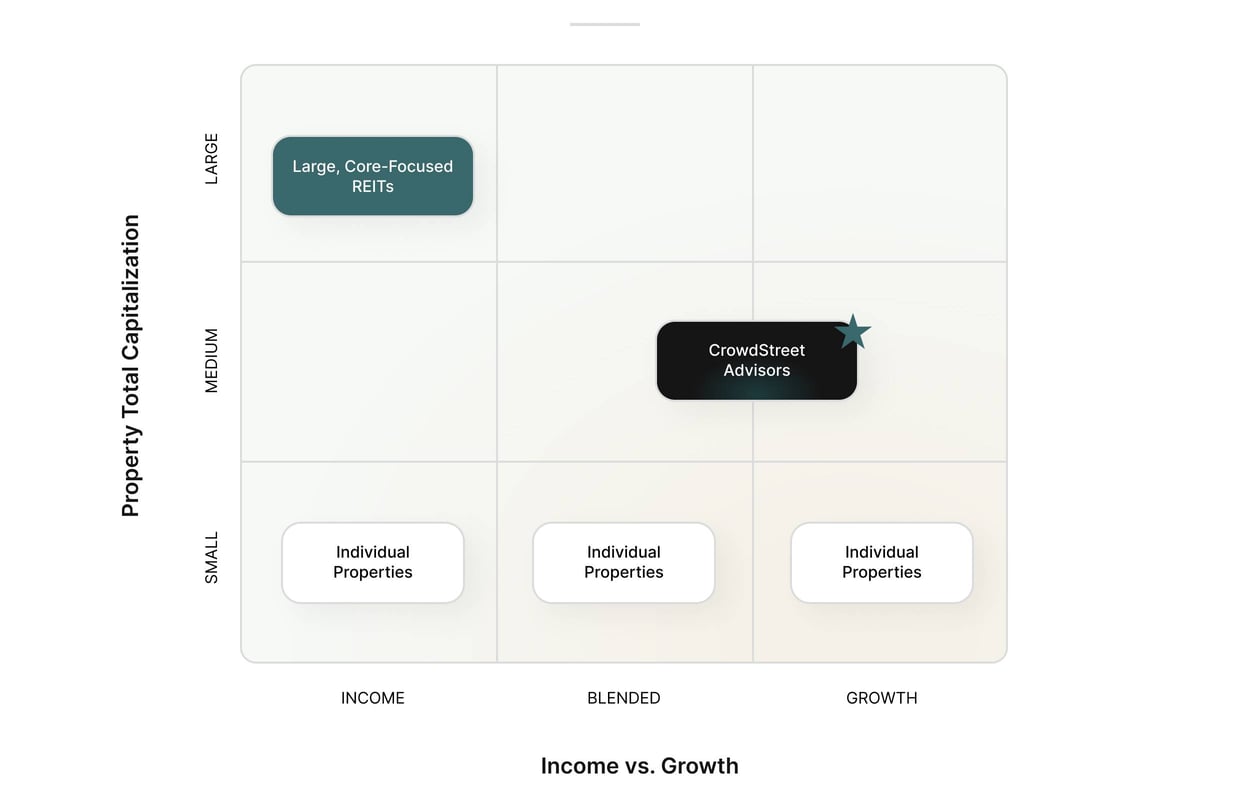

Growth Strategies Designed to Complement Core Strategies

CrowdStreet Advisor funds are designed to seek capital appreciation, adding a new dimension of growth to clients’ portfolios where income-producing real estate funds are more common.

Commercial Real Estate Style Box

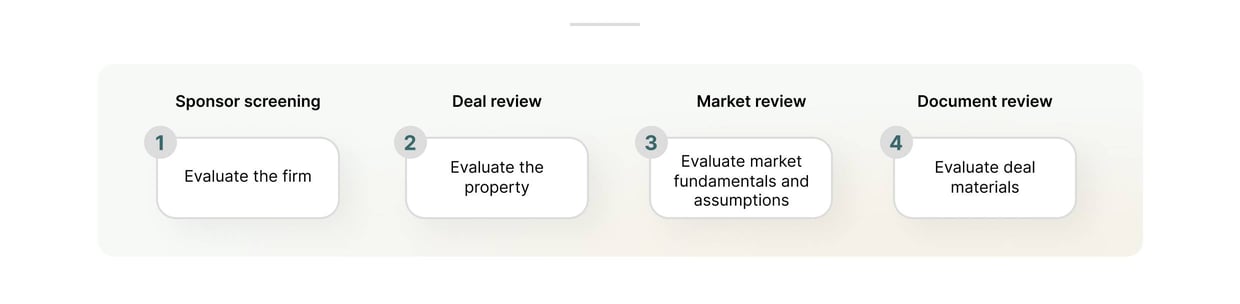

Investment Process

The Investment Committee has early, unparalled access to review the hundreds of offerings sourced for the CrowdStreet Marketplace each year and select which deals a fund will invest in.

However, before a deal reaches the Investment Committee, each opportunity undergoes an in-depth, four-part evaluation operated by seasoned real estate professionals of the CrowdStreet investments team.

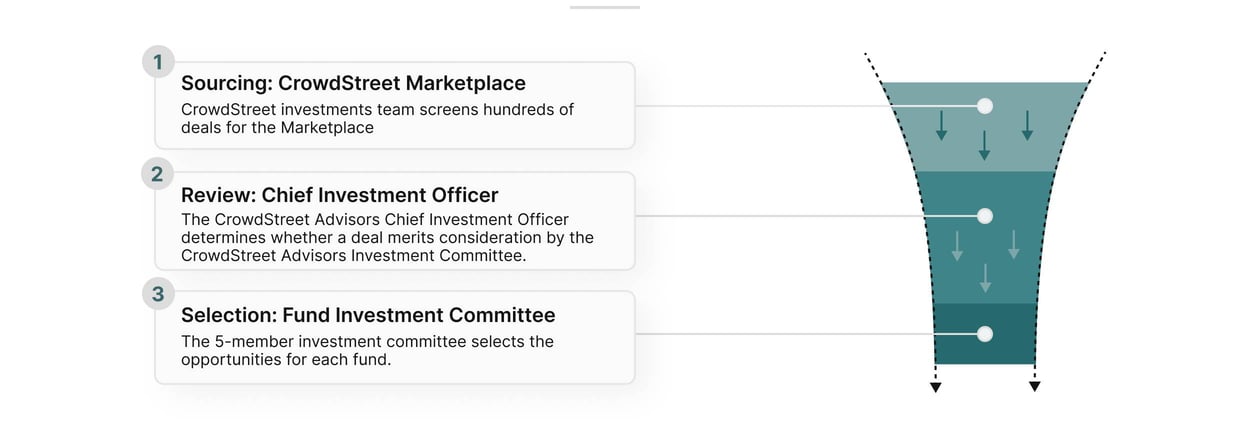

Initial screening: CrowdStreet Marketplace

When a deal passes initial screening, it is next examined by the Office of the Chief Investment Officer of CrowdStreet Advisors to determine whether it warrants review by the Investment Committee. If it does, the Investment Committee reviews the deal against the backdrop of each fund’s current allocation and investment strategy to decide whether the deal should be added to the fund’s portfolio.

Portfolio Construction: How a Deal Is selected for a fund

Let's Talk

Our team is focused on helping advisors serve their clients and meet their investment objectives.

Schedule a Call