Types of Opportunistic Real Estate Deals

Opportunistic real estate projects generally fit into one of the following categories:

Redevelopment: A real estate developer (also known as a "sponsor") buys a property with an existing building with the intent to repurpose it. Two types of redevelopment projects are common: urban infill, and adaptive reuse. Urban infill develops vacant areas in a city with existing infrastructure—like an undeveloped waterfront—while adaptive reuse takes an existing structure and turns it into something else. For example, a sponsor could renovate an old mill into a mixed-use property with shops and restaurants on the ground level and residential lofts above.

New Development: A sponsor buys undeveloped land and puts up a new building from scratch—from the ground up. For instance, a developer could buy an empty lot outside a city and build an industrial cold storage facility. These projects may be build-to-suit, when a project is custom-built specifically for a tenant who agrees to lease the property right away, or these projects may involve a speculative development, which works on an "if you build it, they will come" mentality. Ground-up projects may be less expensive to complete than redevelopment projects and may provide more flexibility in use and design, making obtaining permits and developing the structure more predictable. However, a ground-up project won't bring in cash during construction, so sponsors need to plan carefully to get the project fully operational and leased if they have promised cash flow to investors during the investment term. Sometimes sponsors complete the project in phases, allowing for an exit or cash flow before completing the entire project.

Distressed Project: A sponsor acquires a struggling asset at a steep discount. So-called distressed properties fail to perform at their full potential for a variety of reasons. The new owners need to identify and quickly put into action the changes most likely to help the asset reach its maximum market value. This project likely involves making substantial renovations to better attract the end-user, like purchasing an old, struggling hotel and completing a top-to-bottom renovation to bring it up to Marriott standards. A distressed project may also be financially distressed, meaning the property cannot cover its debt service payments for a prolonged period and can't show the lender a viable path to get back on track.

Stages of an Opportunistic Real Estate Investment

Opportunistic projects generally follow the same real estate process—from purchasing the asset to the asset's eventual sale. Each stage has its risks and considerations, and investors should pay close attention to the specifics outlined in the business plan of a potential investment.

Pre-Development: Before any construction starts, the sponsor needs to get various project approvals. The process can include environmental testing, securing zoning, obtaining building approvals, and government permits. Pre-development is often the riskiest stage of a project.

Development: With the necessary approvals in hand, the sponsor can start working with architects, engineers, and contractors. Pre-leasing may begin during this stage to give the project more time to hit the break-even point and reach a state of consistent cash flow (stabilization).

Lease-Up and Stabilization: Once the building is ready for use, the sponsor will begin leasing to tenants. Upon full occupancy of the property, the sponsor will usually either refinance the project with new debt or sell the asset for a profit.

Exit: Sponsors usually estimate a three- to seven-year holding period between the start of an opportunistic project and the asset's sale, but investment hold periods of as short as one year can occur.

Understanding the Risks of Opportunistic Real Estate

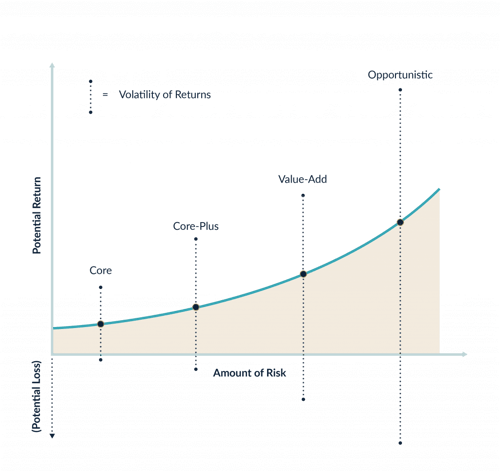

Opportunistic projects typically target 15-25% IRR and an equity multiple of 1.5x-3.5x. These returns are entirely dependent on the execution of the business plan. Regardless of the type of opportunistic project, a few key characteristics may increase the risk of these investments substantially (which is why the targeted returns can be so high), including construction risk, lease-up risk, legal risk, timing, and a lack of cash flow.

Let's assume that a developer has all the government approvals to construct a building from the ground up or to overhaul an existing structure completely. Depending on factors like building type, location, and size, the project's construction phase may take years. If market conditions decline before the project is finished, the completed project's value could be less than the cost to build it. Generating cash when prospective tenants aren't actively leasing can present an even more significant challenge than the construction timeline. Most, if not all, opportunistic projects have debt payments to satisfy. If a project can't generate cash flow, then financial distress could jeopardize the entire investment. However, with a good business plan and the right timing, properties in distress and empty land may be purchased and developed for a far lower cost than the finished asset's market value.

Think of an office building in a Silicon Valley neighborhood that's usually in very high demand. In a severe downturn, tenants might opt not to renew their leases, and the empty office building could go up for sale at a steep discount. If a sponsor can buy the asset for a low enough price, properly manage it, and hold it for long enough, there's a strong probability that the sponsor can sell it for a profit when economic conditions change. The same may hold true for new development projects. Say a vacant lot costs $500,000, and construction of an apartment building costs $1 million. While there's always the risk that things could go awry during the construction process, if all goes to plan, the finished apartment building could be worth $3 million or twice as much as the cost of the land and cost to complete the apartment building. That's a much higher return than could be earned by buying an already successful apartment complex in the same neighborhood.