The best places for real estate investing in 2021

Download the full ranking of our top 20 cities, and see why we are excited about these markets in 2021.

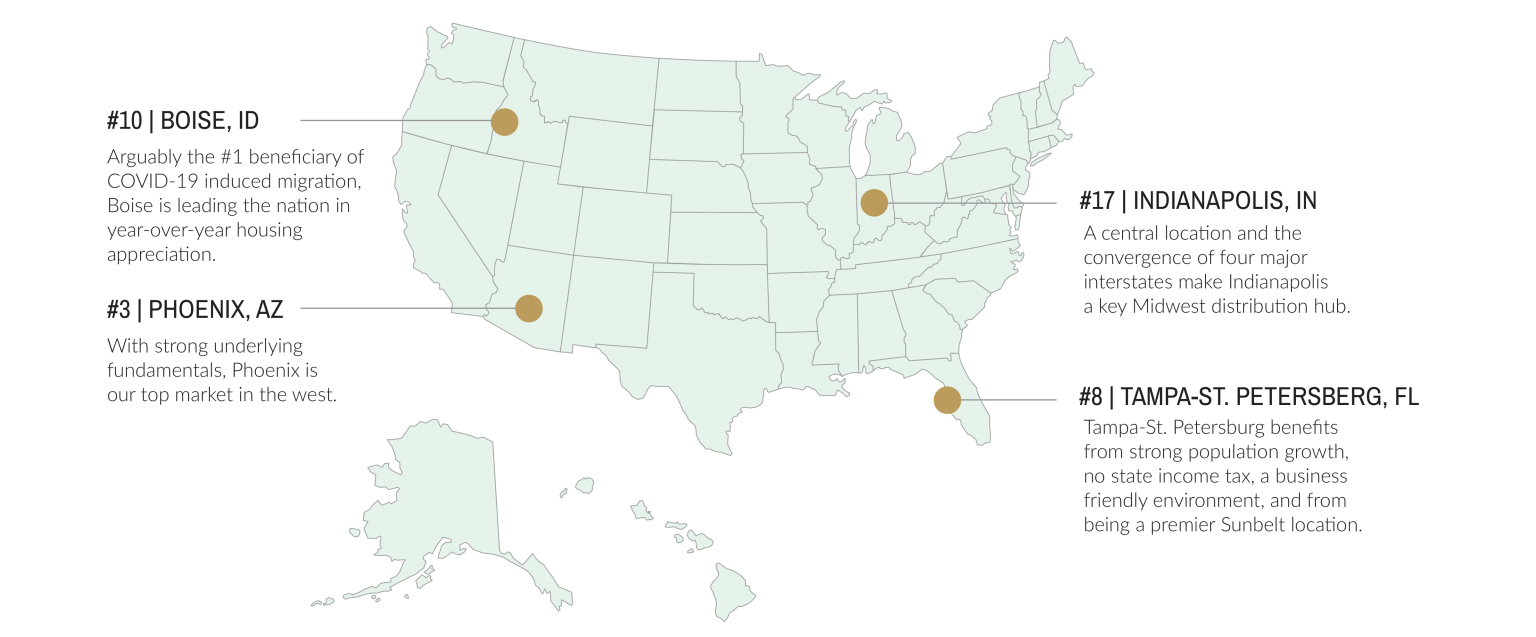

CrowdStreet’s Top 20 Markets

As we move through 2021, the U.S. commercial real estate (CRE) market is poised to move beyond its trough of 2020 and enter a new cycle of growth. Thanks to a reported 3.8% increase in GDP and the mass distribution of COVID-19 vaccines, recovery comes with the anticipation of increased transaction velocity—nearly 40% increase in total U.S. CRE transactions for next year, according to CBRE’s mid-year 2020 report.

In this new cycle, different metros will recover at different rates, and we heavily weighted regional factors like population growth and the employment base when determining the best places to invest in 2021. Our most favored markets also exhibited a subjective desirability or competitive advantage. Whether we label this as a metro’s “vibe” or “quality of life,” CrowdStreet’s best places for real estate investing possess a curated blend of multiple tangible and intangible attributes that coalesce to create attractive communities.

Not all strategies will play out equally across the various markets. We’ve also ranked our best places to invest by asset class, with the understanding that certain properties are more valuable to certain markets, creating unique opportunities for investors. Download the report to see our best real estate markets for 2021 across all asset classes, including niche offerings like manufactured housing and life sciences.

Multifamily Acquisition

As the pandemic unfolded, we witnessed a noticeable shift in renter behavior as people migrated from highly populated urban centers to the suburbs in search of larger units and less densely populated multifamily communities. Overall vacancy rates for suburban multifamily declined, with a 6% national vacancy in Q3 2020, and downtown multifamily vacancy increased to around 9%.

When it comes to purchasing existing multifamily assets already in existence (known as acquisition), our top cities—including Raleigh-Durham, Austin, Nashville, and Phoenix—have favorable business climates, educated workforces, affordability, and population growth. With a focus on above-average population and job growth rates and strong net absorption of apartment units, CrowdStreet sees immense opportunity in our 25 best places for multifamily acquisition.

Multifamily Development

We see a slowdown in the delivery of new, ground-up multifamily assets beginning later this year and extending into 2022. This creates a window of opportunity in 2021 for multifamily development.

When ranking the best places for multifamily development, CrowdStreet prioritized cities that have demonstrated above-average rates for both population and job growth with the expectation those trends will continue. In addition, we looked for locations that presented at least moderate barriers to entry and which current demand supports both densification and the arrival of new housing supply (typically measured through rapid rates of absorption).

CrowdStreet’s top ten markets for this category contain a blend of growing secondary markets (Denver), markets that are smaller but transitioning towards institutional markets with strong underlying fundamentals (Salt Lake City), one primary market we see bouncing back strong post-vaccine (Washington D.C.), and one “work from anywhere” beneficiary (Bozeman).

Industrial

The continued demand for industrial space of all types has been substantially driven by the increase in e-commerce sales, which requires more space than traditional brick-and-mortar retail. Asking rents are expected to continue to increase year-over-year, according to Cushman & Wakefield, while Green Street Advisors projects the industrial sector to be one of only two asset types (along with manufactured housing) to see strong net operating income (NOI) growth in 2021. The industrial sector will need to meet the growing demand for this type of real estate by finding land in strategic locations with enough space to accommodate its large footprints. CrowdStreet views the land limitation factor as a driver for rent growth, low vacancies, and increased tenant renewal rates.

Many of our top industrial markets, such as Northern New Jersey, Dallas-Fort Worth, the Inland

Empire, and Washington D.C., are close to large populations with excellent access to highways, railways, and seaports. The best places for industrial real estate also possess favorable ingress and egress, as well as exhibit strong underlying demographic drivers. CrowdStreet also values smaller infill locations, located closer to the end-user for last-mile distribution.

Office

The office sector entered 2021 with a high level of uncertainty regarding its outlook. At the national level, office utilization rates were exceedingly low at the end of 2020 (on average below 20%) as most office employees worked from home. There are, however, distinct regional effects in play, and businesses such as Facebook and Microsoft have still been leasing space despite offering their employees a flexible work environment.

When ranking the best places for office real estate, CrowdStreet looked for strong population and employment growth trends and an above-national-average net absorption. Markets that CrowdStreet has targeted typically offer employees attractive nearby amenities, lively entertainment, and/or accessibility to nature.

Overall, CrowdStreet views the Sunbelt as possessing the most attractive markets for office in 2021. Metros like Austin, Atlanta, and Raleigh-Durham have demonstrated their resilience in 2020 with the prospect of the resumption of growth later in 2021.

Hospitality

The hotel sector was undeniably the hardest hit in 2020 and the first to feel the effects of the COVID-19 pandemic. However, its dynamic nature also means hospitality is likely to be the distressed asset class with the strongest bounce coming out of the pandemic.

Leisure RevPAR recovery has consistently outperformed business by approximately ten percentage points since June, as reported by STR. As teleconferencing has become a workable alternative to in-person meetings, we believe it will continue to gain favor over non-essential business travel, meaning this side of the sector could trail up to a year behind the leisure recovery.

When ranking the best places for hospitality real estate, CrowdStreet looked for markets like Orlando and New York City that possess demand drivers within the leisure space such as cultural amenities, entertainment venues, tourist attractions, and one-of-a-kind destinations.

When it came to business travel, we focused on demand drivers for essential business travel, such as government, that can’t be replicated in an online environment. We also looked at potential future supply imbalances that could materialize on the other side of the pandemic. Lastly, we considered regulation, specifically in regards to Airbnb, in markets such as San Francisco and Miami.

Retail

As the second hardest-hit asset type after hotels, the retail sector entered 2021 in a weakened state. Aside from grocery stores, most retail locations remain severely limited in

their operations. As we begin to enter the next chapter of brick-and-mortar retail it’s likely that we’ll see some consolidation within the industry as the best-located centers seek to backfill their pandemic-induced vacancies with surviving tenants looking to upgrade their locations. However, as we begin to exercise our regained mobility later this year, there is room for optimism in a continued bounce back in the sector.

When ranking the best places for retail real estate for 2021, CrowdStreet placed value on a number of considerations. The first is muted supply. As an asset class experiencing an extended period of strain, most markets are almost entirely shut off to new supply. That means centers that are still relevant to the submarket, particularly grocery-anchored centers, have little to no worries of new supply to contend with. Second, we considered current prices relative to historical prices. As the sector looks to exit its trough and begin its gradual recovery in 2021, we will prioritize any potential deal that is trading at a discount relative to its 2019 valuation. We also looked at macroeconomic factors such as above-average population growth rates and below-average U.S. unemployment rates, which make cities like Charlotte and Nashville attractive markets for retail. Alternatively, we believe we may find value in markets that have been hard hit during 2020 but have an outlook of rapid improvement, such as Orlando.

Other Assets

We’ve ranked the best places for more niche asset classes as well. Download the report to see our favorite cities for:

LIFE SCIENCES

Life sciences has been a particularly bright spot within the office sector. This subset has not only weathered the pandemic, it has thrived. Life sciences real estate focuses on types of work that cannot be done remotely. The pandemic has served to highlight the essential nature of the work performed by these tenants who often exist in the biochemical or medical fields. When ranking our top life sciences markets for 2021, CrowdStreet placed an emphasis on major research clusters. Cities like Boston, San Diego, and Raleigh-Durham are known for their vibrant life sciences ecosystems and robust academic research.

BUILD-TO-RENT

The rise of Build-to-Rent (BTR) communities is fueled by the current tenant migratory trend that has been opting out of smaller, denser urban housing in favor of larger, less dense housing options. Millennials, in particular, are driving a portion of this demand. This demographic is looking for more space as they contemplate a post-pandemic world where they still work from home a portion of the week. As an emerging housing product type, BTR can provide more space at a lower price per square foot as it is purpose-built for this specific type of demand. CrowdStreet looked for markets that were less land constrained as building this product requires three to four times as much space as a standard garden-style multifamily property for the same number of units. Markets such as Phoenix, Huntsville, and Cape Coral-Fort Meyers are strong candidates for BTR.

MANUFACTURED HOUSING

Manufactured housing is a niche asset class with a long track record of strong performance. While once a mom-and-pop asset class, manufactured housing has graduated to the ranks of institutional ownership and has even entered the public REIT arena. The robust fundamentals in this led Green Street Advisors to rate it as its favorite asset class for both 2021, as well as in its Outlook through 2024. In ranking our top states for this asset class, we prioritized muted supply and inbound migration trends with an emphasis on 60+ year olds. States like Arizona, Texas, and Washington fit the bill.

In conclusion

As we journey into 2021, we sit at a pivotal moment for the commercial real estate market. Markets will undoubtedly change and we will monitor and adjust accordingly. Many of our best real estate markets, including Raleigh-Durham, Austin, Nashville, Denver, and Atlanta, exhibit strong trends we view as translating to sustainable growth over the next decade. However, we understand that supply can overshoot demand in the short term. To the extent that it begins to do so in our favorite cities, leading them to overheat, we will change our rankings to reflect and provide new guidance on their relative positions.

The CrowdStreet Investments team leveraged the following sources of information to determine our 2021 top markets rankings: Green Street Advisors, CoStar, ULI Emerging Trends in Real Estate, CrowdStreet platform portfolio analysis, CrowdStreet Investments team experience, and interviews with real estate industry professionals (operators, capital markets professionals, brokers, etc).

Download the report to see our full methodology, including our most-favored attributes that helped determine our best places for real estate investing in ’21.

This content was written by an employee of CrowdStreet, Inc. (“CrowdStreet”) and has been prepared solely for informational purposes. The information contained herein or presented herewith is not a recommendation of, or solicitation for, the subscription, purchase or sale of any security or offering, including but not limited to any offering which may invest in the geographic area(s) or asset type(s) mentioned herein, whether or not such offering is posted on the CrowdStreet Marketplace. Though CrowdStreet believes the information contained and compiled herein has been obtained from sources believed to be reliable, CrowdStreet makes no guarantee, warranty or representation about it. Any projections, opinions, assumptions or estimates used are for example only and do not represent the current or future performance of the subject thereof. All projections, forecasts, and estimates of returns or future performance, and other “forward-looking” information not purely historical in nature are based on assumptions, which are unlikely to be consistent with, and may differ materially from, actual events or conditions. Such forward-looking information only illustrates hypothetical results under certain assumptions.

CrowdStreet is not a registered broker-dealer or investment adviser. Nothing herein should be construed as an offer, recommendation, or solicitation to buy or sell any security or investment product issued by CrowdStreet or otherwise. This page is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any investor. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. All investors should consider such factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate.